The FHA loan program is a mortgage loan that is insured by the Federal Housing Administration (FHA). The federal government insures loans for FHA-approved lenders in order to reduce their risk of loss if a borrower defaults on their mortgage payments. In addition to FHA, the federal government also has other mortgage programs in the way of USDA Rural Housing and VA.

The FHA loan program is a mortgage loan that is insured by the Federal Housing Administration (FHA). The federal government insures loans for FHA-approved lenders in order to reduce their risk of loss if a borrower defaults on their mortgage payments. In addition to FHA, the federal government also has other mortgage programs in the way of USDA Rural Housing and VA.

The FHA program was created in response to the rash of foreclosures and defaults that happened in the 1930s; to provide mortgage lenders with adequate insurance, and to help stimulate the housing market by making loans accessible and affordable. Today in 2023 FHA loans are very popular, especially with first-time homebuyers that have limited money saved for down payments. FHA loans don’t require a big 20% down payment like many conventional loans.

So What Are the Advantages of FHA Loans?

Typically an FHA loan is one of the easiest types of mortgage loans to qualify for because it requires a low down payment and you can have less-than-perfect credit. An FHA down payment of 3.5 % is required. Borrowers who cannot afford a traditional down payment of 20% or can’t get approved for private mortgage insurance should look into whether an FHA loan is the best option for their personal scenario.

Another advantage of an FHA loan is that it can be assumable, which means if you want to sell your home, the buyer can “assume” the loan you have. People who have low or bad credit, have undergone bankruptcy or have been foreclosed upon may be able to still qualify for an FHA loan.

What Are the Disadvantages of an FHA Mortgage?

Plain and simple… mortgage insurance. Because an FHA loan does not have the strict standards of a conventional loan, it requires two kinds of mortgage insurance premiums: one is paid in full upfront – or, it can be financed into the mortgage – and the other is a monthly payment. Also, FHA loans require that the house meet certain conditions and must be appraised by an FHA-approved appraiser.

FHA Upfront mortgage insurance premium (MIP) — Appropriately named, this is an upfront monthly premium payment, which means borrowers will pay a premium of 1.75% of the home loan, regardless of their credit score. Example: $300,000 loan x 1.75% = $5,250. This sum can be paid upfront at closing as part of the settlement charges, or can be rolled into the mortgage.

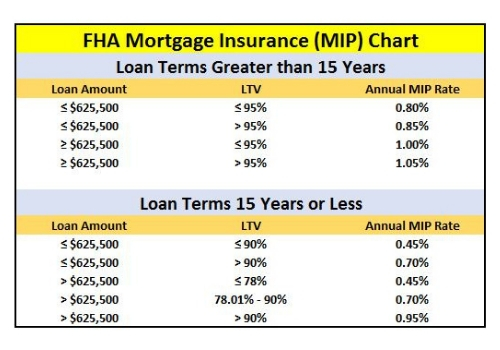

FHA Annual MIP (charged monthly) —Called an annual premium, this is actually a monthly charge that will be figured into your mortgage payment. It is based on a borrower’s loan-to-value (LTV) ratio, loan size, and length of loan. There are different Annual MIP values for loans with a term greater than 15 years and loans with a term of less than or equal to 15 years. Loans with a term of greater than 15 Years and Loan amount < or =$limit.

Single-family home mortgages with amortization terms of 15 years or less, and a loan-to-value (LTV) ratio of 78 percent or less, remain exempt from the annual MIP. Confused? Call us at ph: 800-743-7556, we are always happy to help!

FHA Mortgage Insurance Duration

- The duration of your annual MIP will depend on the amortization term and LTV ratio on your loan origination date. Please refer to this MIP chart located here for more information:

FHA Loan Requirements

- Must have a steady employment history or worked for the same employer for the past two years.

- Must have a valid Social Security number, lawful residency in the U.S. and be of legal age to sign a mortgage in your state.

- Must make a minimum down payment of 3.5 percent. The money can be gifted by a family member.

- New FHA loans are only available for primary residence occupancy, no investment or rental homes.

- Must have a property appraisal from an FHA-approved appraiser.

- Your front-end ratio (mortgage payment plus HOA fees, property taxes, mortgage insurance, home insurance) typically needs to be less than 31 percent of your gross income, typically. You may be able to get approved with as high a percentage as 46.99 percent. Your lender will be required to provide justification as to why they believe the mortgage presents an acceptable risk. The lender must include any compensating factors used for loan approval.

- Your back-end ratio (mortgage plus all your monthly debt, i.e., credit card payment, car payment, student loans, etc.) needs to be less than 43 percent of your gross income, typically. You may be able to get approved with as high a percentage as 56.99 percent. Your lender will be required to provide justification as to why they believe the mortgage presents an acceptable risk. The lender must include any compensating factors used for loan approval.

- A minimum credit score of 620 for a maximum financing of 96.5%.

- A minimum credit score of 580 for a maximum LTV of 90 percent with a minimum down payment of 10 percent. FHA-qualified lenders will use a case-by-case basis to determine an applicant’s creditworthiness.

- Typically, you must be two years out of bankruptcy and have re-established good credit. Exceptions can be made if you are out of bankruptcy for more than one year if there were extenuating circumstances beyond your control that caused the bankruptcy and you’ve managed your money in a responsible manner.

- Typically, you must be four years out of foreclosure and have re-established good credit. Exceptions can be made if there are extenuating circumstances and you’ve improved your credit. If you were unable to sell your home because you had to move to a new area, this does not qualify as an exception to the four-year foreclosure requirement.

Property needs to meet certain HUD standards: Also, an FHA loan requires that a property meet certain minimum standards at appraisal. If the home you are purchasing does not meet these standards and a seller will not agree to the required repairs, your only option is to pay for the required repairs at closing (to be held in escrow until the repairs are complete)

FHA Loan Limits

There are maximum FHA loan limits that vary by county. Most counties limit loans to $498,257. In certain high-cost counties, you may be able to get financing for a loan size over $1,000,000 with a 3.5 percent down payment. To find out the FHA mortgage limits in your area, click here.

I’m a prospective homebuyer, how can I qualify for an FHA loan?

Contact us at Ph: 800-743-7556 7 days a week. You can also just submit the short info request on the right side of this screen for a quick call back.