The housing market in Daytona Beach remains strong with the median listing home price selling for $260K. First-time buyers make up a large percentage of homebuyers, especially for properties selling for less than $350K.

The housing market in Daytona Beach remains strong with the median listing home price selling for $260K. First-time buyers make up a large percentage of homebuyers, especially for properties selling for less than $350K.

Today buyers can still purchase a home today with a very little down payment. In fact, FHA loans still permit up to 96.5% financing for qualified buyers throughout Florida.

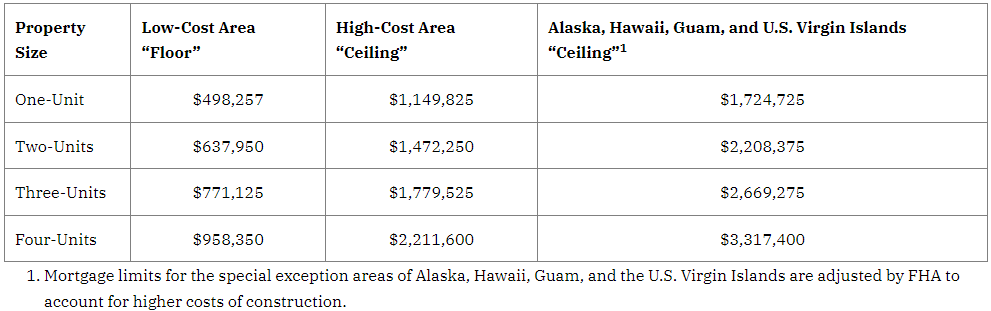

The 2024 FHA loan limits in Volusia County can range from $498,257 for a 1-unit single-family home, up to $958,350 for 4-unit properties. Buyers can find the complete county by county FHA Loan Limit list here.

FHA continues to adjust mortgage guidelines for purchase and refinance borrowers. Listed below are a few things to help make sense of the application process and loan requirements for 2024:

FHA Mortgage Quick Facts For Daytona Beach Home Buyers:

- FHA still permits up to 96.5% financing. Much less than the 5% or 10% required by conventional loan programs.

- Home sellers can pay up to 6% of buyers’ closing costs, so all the borrower will need is the 3.5% down payment.

- The FHA program is NOT limited to just first-time homeowners.

- FHA loans offer secure 15 or 30-year fix terms, along with adjustable-rate options.

- FHA loans have less restrictive credit requirements when compared to many conventional mortgages.

- FHA loans are backed by the US Government.

- Income-eligible first-time buyers in Florida have the Hometown Heroes program available to help with down payment and closing costs assistance up to $35,000.

Documentation Needed for FHA Application:

Documentation Needed for FHA Application:

- Primary and co-borrowers income, current and full two-year job history with W2 and/or tax returns.

- Last (2) pay stubs for regularly employed home buyers.

- Asset account balances including checking, savings, and retirement accounts like 401K, etc.

- Location and property type (single-family home, etc)

- Primary and Co-Borrower Social Security Numbers for the credit report processing

- Last two years of living history – address, etc.

- Copy of ID and/or driver’s license.

If your credit profile needs a little help, keep in mind that FHA does permit non-occupying co-borrowers such as parents, grandparents, or any direct family member who can strengthen the file. Co-borrowers can bring more income or a stronger credit profile to the file and help you immensely in qualifying.

However, it’s important to remember that the qualifying credit score used, will be the lower of the two borrowers. One borrower that has really high credit score cannot “offset” another borrower that may have bad credit. The current minimum required credit score for most lenders and banks is 600.

Questions? We are ready to help 7 days a week. For fast service please submit the Info Request Form on this page. Serving buyers throughout Fla including Ormond Beach, Deltona, Port Orange, Deland, New Smyrna Beach, Debary, and Orange City.

Documentation Needed for FHA Application:

Documentation Needed for FHA Application: