There are two primary types of mortgage loans available in today’s marketplace- conventional and government-backed. Conventional loans are those made by lenders who assume the risk of the mortgage loan and are not compensated in any way should the loan eventually go into default. Government-backed mortgages do have a degree of guarantee to the lender.

There are two primary types of mortgage loans available in today’s marketplace- conventional and government-backed. Conventional loans are those made by lenders who assume the risk of the mortgage loan and are not compensated in any way should the loan eventually go into default. Government-backed mortgages do have a degree of guarantee to the lender.

There are three such government backed loans, VA, USDA, and FHA. Should such a loan go into default, the lender is compensated for all or part of the loss. If a VA loan goes into foreclosure, the lender is compensated at 25% of the loss, while a USDA loan provides 100% compensation for a loss. So too does the FHA home loan compensate the lender for all the loss should the loan default.

These guarantees are not free. In fact, they are paid for by the borrower in the form of mortgage insurance. With FHA loans, there are two such FHA insurance policies. First is the one-time upfront mortgage insurance premium that is financed into the loan amount, and second is an annual premium that is paid for in monthly installments.

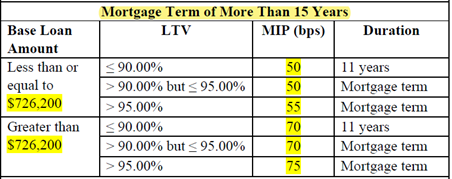

The upfront fee is currently 1.75% of the initial loan amount and is rolled into the amount financed. The annual mortgage insurance premium can vary based on the loan amount and down payment.

Please find the calculation examples on the FHA Details page here.

It’s not uncommon for first time home buyers to misunderstand the concept of “guarantee.” The FHA guarantee does not mean the borrowers are guaranteed for an approval. It means the loan is guaranteed to be compensated for the loss should the loan go into default.

Of the three government-backed loans, only the FHA loan doesn’t have certain restrictions that VA and USDA loans do. For instance, to be eligible for a VA loan, the borrower must be a veteran or active duty. USDA loans are designed to assist buyers in strictly rural areas to obtain competitive financing. In addition, household income is limited to a certain amount for all occupants who work and are over 18.

Anyone can apply for an FHA loan, as there are no such limitations. There are certain loan limits for an FHA loan based upon the location of the property and can vary state by state. For instance, an FHA loan limit might be higher in Los Angeles, CA when compared to an FHA loan limit in Kansas City.

What to learn more? Just submit the quick Info Request Form on this page.