Are you located in a more rural area of Florida? If so, maybe the 100% USDA home loan can benefit you.

Are you located in a more rural area of Florida? If so, maybe the 100% USDA home loan can benefit you.

Some background – The USDA Rural Development Home Loan is the last remaining no down payment government-insured mortgage program for Florida civilians. The USDA mortgage program is designed to help promote homeownership in less populated locations around Florida. Many people assume the USDA loan program is only for farmers or ranchers, not true.

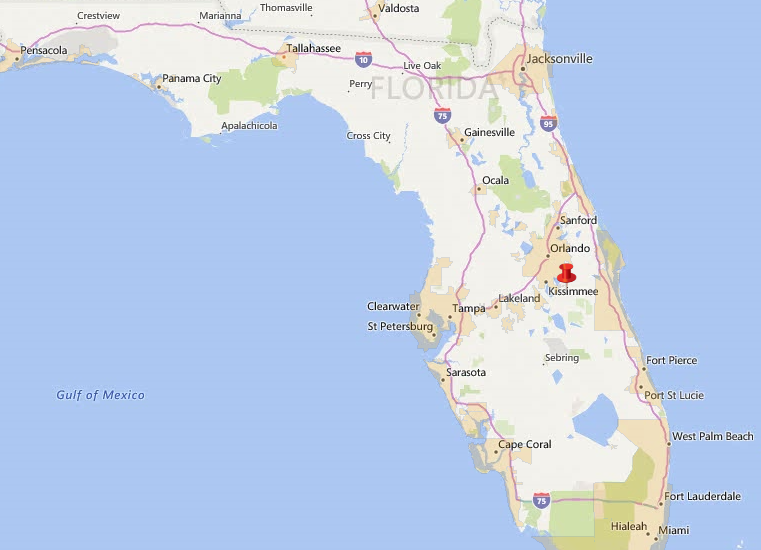

Many major metropolitan areas have outlining areas that are qualified for USDA eligible property locations. Even locations around major Florida cities like Jacksonville, Orlando, Tampa, Gainesville, Ocala, Tallahassee, and Pensacola have USDA-eligible locations around them. Interested homebuyers can click here to view USDA-eligible zones in their location.

The USDA loan program will allow homebuyers to borrow up to 101% of the home’s appraised value. In addition, homebuyers can include closing costs into their loan assuming their appraised value is sufficient. Please click here to learn more.

Some benefits of a USDA Home Loan include:

- 101% Financing, No Down Payment required!

- Low monthly mortgage insurance (PMI) Just a one-time USDA funding fee that is included in your loan.

- No Loan Amount limits.

- No Cash Reserve Requirements

- 6% Seller Contribution Limitations

- 100% Gifted Closing Costs allowed

- 30 year low fixed rate loan

- No Prepayment Penalty

- Primary Residents only (no rentals/investments or second homes permitted)

- 620 min credit score required for USDA home loans.

To qualify for the USDA loan program, there are two main requirements that differ from the other government loan programs (FHA or VA loan program)

Property Location: The home must be located in a Florida USDA-eligible designated rural area. Buyers can find the complete USDA eligibility map here. Remember, the seller of the property is not important, just where the property is physically located.

Household Income: Each county has different USDA Income restrictions. The income limit is based on many different variables. In most of Florida and the rest of the U.S. household income is limited to $110,650 for a family of 1–4 members. $146,050 for larger families of 5+ members. Income limits in more expensive high-cost locations are even higher, please click here to learn more.

Questions about USDA / RD home loans? Call us at 800-743-7556. Please also visit our blog for the latest Florida USDA home loan information.

Proudly serving all of Florida 7 days a week.

Serving all of Florida 2024:

Apopka FL | Archer FL| Aventura FL| Boca Raton FL | Bradenton FL| Brandon FL| Cape Coral FL| Clearwater FL| Clermont FL |Cocoa Beach FL | Coconut Creek FL | Coral Gables FL| Crestview FL| Crystal River FL| Daytona Beach FL| DeLand FL | Deltona FL| Delray Beach FL | Destin FL| Dunedin FL | Englewood FL| Fernandina Beach FL| Flagler Beach FL| Fort Lauderdale FL | Fort Myers FL | Fort Pierce FL | Fort Walton Beach FL| Gainesville FL| Green Cove Springs FL| Hallandale FL| High Springs FL|Hobe Sound FL| Hollywood FL| Homestead FL| Inverness FL | Jacksonville FL| Jasper FL |Jupiter FL| Key Largo FL| Key West FL|Keystone Heights FL|Lady Lake FL| Lakeland FL| Lake City FL| Lake Mary FL| Land O Lakes FL|Live Oak FL| MacClenny FL|Madison FL| Melbourne FL| Miami Dade FL | Milton FL| Mount Dora FL | Naples FL| Ocala FL | Ocoee FL |Ojus FL | Orange Park FL| Orlando FL| Ormond Beach FL| Palatka FL| Palm Bay FL| Palm Coast FL | Panama City Beach FL| Pensacola FL| Pompano Beach FL| Port Charlotte FL| Port St. Lucie FL | Punta Gorda FL| Santa Rosa FL| Sarasota FL | Siesta Key FL| Spring Hill FL | St. Augustine FL| Starke FL|St. Petersburg FL | Sunny Isles FL| Tallahassee FL| Tamarac FL| Tampa FL| Titusville FL | Venice FL| Vero Beach FL| Weeki Wachee FL| Wesley Chapel FL| West Palm Beach FL | Winter Garden FL| Winter Haven FL| Winter Park FL| Winter Springs FL| White Springs FL| Zephyrhills FL| Florida |FLA

Alachua County| Baker County | Bay County | Bradford County | Brevard County | Broward County | Calhoun County | Charlotte County | Citrus County | Clay County | Collier County | Columbia County | Dade County | De Soto County | Dixie County | Duval County | Escambia County | Flagler County |Franklin County | Gadsden County | Gilchrist County | Glades County | Gulf County | Hamilton County | Hardee County | Hendry County | Hernando County |Highlands County | Hillsborough County | Holmes County | Indian River County |Jackson County | Jefferson County | Lafayette County | Lake County | Lee County| Leon County | Levy County | Liberty County | Madison County | Manatee County| Marion County | Martin County | Monroe County | Nassau County | Okaloosa County | Okeechobee County | Orange County | Osceola County | Palm Beach County | Pasco County | Pinellas County | Polk County | Putnam County | St. Johns County | St. Lucie County | Santa Rosa County | Sarasota County | Seminole County | Sumter County | Suwannee County | Taylor County | Union County |Volusia County | Wakulla County | Walton County | Washington County