It’s an annual tradition that happens in the fourth quarter of each and every year. Well, maybe not a tradition in the sense of a holiday but the mortgage industry certainly takes notice. What is this event? Back in 2008 as part of the Home Equity Recovery Act, or HERA, the Federal Housing Finance Agency was created.

It’s an annual tradition that happens in the fourth quarter of each and every year. Well, maybe not a tradition in the sense of a holiday but the mortgage industry certainly takes notice. What is this event? Back in 2008 as part of the Home Equity Recovery Act, or HERA, the Federal Housing Finance Agency was created.

One of the more important functions of FHFA is to decide whether or not to adjust the conforming loan limits for the following year. These adjustments follow a strict protocol. In October of each year, FHFA reviews the Housing Price Index, or HPI, to see if an adjustment is warranted.

The HPI compares the national median home value for the current year with the previous year’s HPI. If there is an increase in the HPI, the new conforming loan limits will also be adjusted by the same percentage. If there is no year-to-year increase or if home values actually fall, the conforming loan limits will be left intact for the following year and wait for the next review. The announcement of the new limits takes place in November and the new limits take place on the first day of the following year.

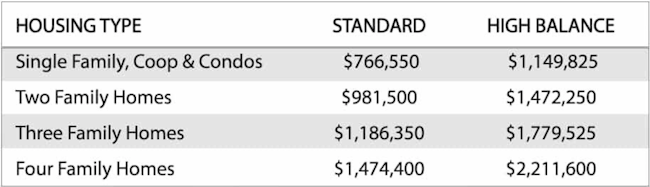

For 2023, the conforming loan limit for most parts of the country is $766,550 for a single-family home. Higher adjustments are also made for two, three and four-unit residential properties.

Conforming Loan Limits for 2024:

Conforming loans are those that meet guidelines established by Fannie Mae and Freddie Mac and as long as an individual loan is underwritten to these standards, including meeting the loan limits, the loans are then eligible for sale in the secondary market. Lenders need to sell loans in order to replenish credit lines used to fund even more loans.

Conforming mortgages make up nearly two-thirds of all residential loans made in the U.S. and will carry more competitive interest rates compared to other types of loans. This increases affordability as well as establishing universal lending guidelines mortgage companies can follow.

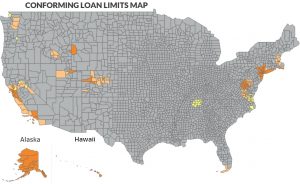

In areas where the median value of home prices is much higher compared to the rest of the country, adjustments are made accordingly. These areas are designated as “high-cost” areas, think California, Hawaii, Washington DC, and most large cities in the North East. *See the map below as the colored areas indicate locations that have higher limits. Conforming loan limits in these areas can be as high as $1,149,825, or 150 percent of the standard conforming limit of $766,550.

High-cost area loans may also be eligible for sale in the secondary market, including directly to Fannie Mae and Freddie Mac. Almost every mortgage lender in the country offers a conventional conforming loan and follows these guidelines. Any loan that exceeds these limits would be considered a “Jumbo” loan. Financing for Jumbo mortgages works similar to regular conventional loans, buyers can read all the latest Jumbo loan limits & down payment requirements here.

Please connect with us today with questions or to learn more. Please call the number below, or just submit the Info Request Form on this page for expedited service.