There are two primary types of mortgage loans available in today’s mortgage marketplace, VA, USDA, and FHA all fall into the government-backed category. Conventional loans are a little different due to the fact that the bank assumes the risk on a loan with no government backing. Government-backed loans will compensate …Read More

FHA Home Loan News, Tips & Information

Titusville FHA Loan Lender

FHA home loans have continued to gain popularity for new home buyers across Florida. Many homebuyers around Titusville, New Smyrna Beach and Cocoa Beach want financing options that offer min down payment like the FHA program. In addition to the low 3.5% down payment requirement, FHA recently announced the monthly …Read More

FHA Loan Guarantee Fee Explained

There are two primary types of mortgage loans available in today’s marketplace- conventional and government-backed. Conventional loans are those made by lenders who assume the risk of the mortgage loan and are not compensated in any way should the loan eventually go into default. Government-backed mortgages do have a degree …Read More

Jacksonville FHA Lending Loan Limits, Guidelines

The FHA (Federal Housing Administration) is the largest insurer of mortgages in the world, backing over 34 million properties since the 1930’s. FHA provides mortgage lenders with insurance on all loans funded in refinancing or purchasing a home. Mortgage companies are in a sense protected or insured should a buyer …Read More

FHA 203(k) Loan Program Requirements 2024

The Federal Housing Administration first introduced the FHA home loan program back in 1934. Prior to this time, there really were no universal lending guidelines banks could follow. Instead, banks could issue a loan to buy a home under most standards they deemed necessary. Down payment requirements for most loan …Read More

2024 Government Loan Options

Pretty much all the Government-backed mortgages like FHA, USDA and VA require the same things when getting pre-approved. Here are several key points to think about when deciding to apply for a Government home loan. We also included a short description of the most popular 2024 Government Loan Options today. …Read More

Tennessee First Time Home Owners – 2024 Updates

Tennessee First Time Home Owners have some wonderful choices for mortgage financing this year. The most popular home loans for first-time buyers are Government-backed programs like USDA, FHA, and VA loans. Below we will talk about each program, and discuss the advantages to help you choose the option best for …Read More

Tips for First Time Homebuyers 2024

Are you gearing up to buy your very first home? We’re heading into home buying season and before long the next thing you know you’ll be living in your brand new home. Buying a home and getting a mortgage is a brand new adventure for many, so to make the …Read More

2024 FHA Monthly Payment Calculator

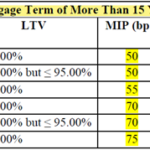

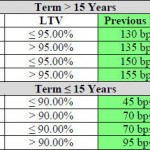

Homebuyers want to be sure they use an accurate FHA mortgage payment calculator when figuring up monthly loan payments. Keep in mind many online mortgage payment calculators do NOT apply the applicable mortgage insurance, taxes, and insurance. Please note each mortgage program has different monthly mortgage insurance (MIP, PMI) amounts. …Read More

FHA Mortgage Insurance Calculator 2024

We recently revised our FHA mortgage payment calculator on the right side of the page. This FHA mortgage payment calculator figures the principal, loan interest, taxes, home insurance, and FHA mortgage insurance “PMI” costs. Homebuyers will want to adjust the taxes and home insurance as needed, as each home will …Read More