The housing market in California has remained strong as we start 2024. The median home price according to Zillow for the state is currently $746,900. This represents a slight increase year over year.

The housing market in California has remained strong as we start 2024. The median home price according to Zillow for the state is currently $746,900. This represents a slight increase year over year.

Of course California has many higher-priced properties that require Jumbo financing. Jumbo loans are defined as mortgages that exceed the standard conforming loan limits.

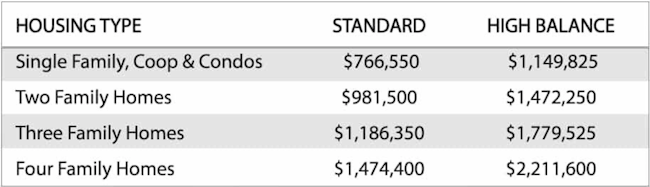

The 2024 conforming loan limits are currently set to $766,550 in most locations in California, except for some higher-cost locations like San Francisco and Los Angeles where the limits can go up to $1,149,825 for a single (1) unit property. Muti-unit homes like duplexes, triplex, etc have even higher loan caps.

Base Conforming Loan Limits for 2024:

Conforming loan limits for major counties & cities in CA:

Los Angeles/ Orange: $1,149,825

San Francisco: $1,149,825

San Jose/Santa Clara County: $1,149,825

Riverside County: $1,149,825

San Diego: $1,00,6250

Sacramento: $766,550

Jumbo loans typically require a larger down payment than conventional loans as they pose more risk to the lenders and banks that originate them.

Lenders often have tighter requirements on jumbo loans because of the incurred risk of lending out more money on a single property and borrower. Additionally, Jumbo loans are typically harder for lenders to resell on the secondary markets making them less attractive for many California mortgage lenders.

While buyers can likely find mortgage lenders to offer a conventional mortgage with less than a 20% down payment, jumbo loans with less than 20% down are harder to find. However, that’s all starting to change thanks to recent guideline changes in the jumbo markets.

A select few mortgage companies are now offering jumbo financing up to 95 percent loan to value – only a 5% down payment. This low down payment option is especially good for buyers in higher costs, traditionally more expensive locations like San Francisco, Los Angeles, San Diego, San Jose, Sacramento, etc. The median home listing price often exceeds $1mil in these counties.

California Jumbo Loan Requirements:

California Jumbo Loan Requirements:

- The max 95% Jumbo financing option only applies to owner-occupied single-family homes, townhomes and condos. Second homes are also permitted with a 5% down payment. Vacant land and lot loans are not permitted. Building on your own site is permitted through special Jumbo construction loans.

- Applicants must be able to document all income and assets necessary for loan approval. Pay stubs, tax returns, etc

- Standard debt-to-income limits similar to conventional loans apply. The limit for total expense + housing is generally 45%

- A credit score of 680 or better is required to be approved for the 5% down jumbo option. Homebuyers with lower credit scores down to 660 have options with a greater 10%+ down payment

- Must be a U.S citizen

- Homebuyers must occupy the home within 30 days of the closing

- Buyers will need reserves for most programs. This is the amount of savings retained after the down payment and closing costs are made. Reserve standards can be satisfied by retirement/investment accounts – see below

California Jumbo Loan Amount Limits:

- 95% Jumbo – loan limit cap $2,000,000 – 3 months payment reserves required

- 90% Jumbo – loan limit cap $3,000,000 – 6 months payment reserves required

- 85% Jumbo – loan limit cap $3,500,000 – 9-12 months payment reserves required

- 80%-70% Jumbo – super jumbo loan limits available up to $9mil.

Jumbo Loan Benefits:

- No private mortgage insurance PMI options – single loan and combo piggyback loan options

- 30-year fix rate, 15-year, or common adjustable-rate (ARM) options like 5/1, 7/1, etc

- No early payoff penalty

- Flexible jumbo refinance options available for both interest rate reductions and cash-out refinance

- Second home and vacation homes are permitted with a 10%+ down payment

Serving home buyers across California: LA, Fresno, Sacramento, Oakland, Bakersfield, Anaheim, Riverside, Stockton, Irvine, Fremont

Homebuyers that have questions or want to apply (7 days a week) can learn more by visiting Jumbo Mortgage Source here

California Jumbo Loan Requirements:

California Jumbo Loan Requirements: