Below we have listed an overview of the FHA loan program.

Please contact us 7 days a week by calling the number above, or just submit the form on this page.

- FHA home loans require only 3.5% down payment for home purchases – up to 96.5% financing. In addition, new down payment assistance programs are available to qualified borrowers. Not only can this help with the down payment, but also with closing costs.

- FHA offers many flexible streamline and cash-out refinancing options for existing homeowners. Learn more under FHA refinance page above.

- FHA home loans are secure and backed by the US Government and have NO prepayment penalty.

- Homebuyers can use gift funds to help pay for the down payment and closing costs expenses.

- Closing costs can also be paid by the seller of the home.

- Qualifying for an FHA loan with lower credit scores is possible. *Please note, the current min required credit score is 620 for max 96.5% FHA financing*

- FHA home loans are secure fixed terms at low market interest rates. Interest rates are very comparable to conventional loans that require a large down payment.

- No household income restrictions.

- FHA home loans are for ANY new & existing single-family residence, townhome or FHA-approved condo. The property being purchased can be a regular sale, short sale, foreclosure home, etc.

- Co-signers and non-occupying home buyers are also permitted!

- Great for public service workers like Teachers, Firefighters, and Police

Other FHA Loan Programs:

Other FHA Loan Programs:

- FHA 203k loans: This program is good for home buyers that want to purchase a home and also includes renovation costs. The 203k mortgage let you borrow money for buying a home and performing extensive renovation using just one single loan. This allows buyers to purchase homes and make them fit for occupancy. Compare this to a regular FHA loan that only permits home buying, and not any repair or renovation work that may be needed. Learn more about FHA 203(k) loans

- FHA HUD $100 Program: This special $100 down home loan for select HUD-owned homes only. Click the highlighted link to read about the HUD 100 down program.

- Florida Hometown Heroes Program: Big changes were recently announced for the Hometown Heroes loan as it is now available to ALL first-time home buyers who work for a Florida-based business. No longer just for front-line workers, the program’s down payment assistance amount has also increased. The program is only for FL homebuyers who meet the qualifying and income eligibility requirements. Learn more about Florida Hometown Heroes Program here.

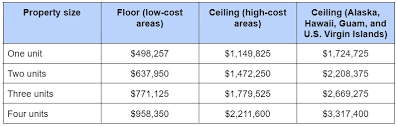

2024 FHA Loan Limits:

FHA mortgages do have a maximum loan amount limit depending on the county/location of your new home. Most counties have a maximum loan limit of at least $498,257. High-cost counties in Florida, Georgia, California, etc, have increased loan amount limits. Buyers can look up the latest 2024 FHA loan limits here.

Mortgage Insurance:

FHA home loans require a one-time upfront mortgage insurance premium (UFMIP) of 1.75% that is rolled into the borrower’s loan. In addition to this, FHA home loans have a monthly premium as well. It’s important not to confuse the one-time upfront premium (UFMIP) and the monthly MIP.

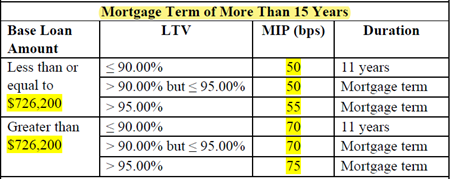

The monthly premium depends on the loan terms (30 yr, 15 yr, etc) and the down payment you choose. Please see the chart below for the current FHA mortgage insurance premiums.

*Example of the monthly mortgage insurance premium costs based on the chart above:

The sales price of your new home = $200,000

You have decided to use the FHA 30-year fix rate with a 3.5% down payment = $7,000

Loan amount = $193,000

Based on this scenario, your FHA monthly mortgage insurance costs (PMI) would be:

$193,000 x .0055 = $1,061.50. Now divide $1,061.50 by 12 months = $88.45 in monthly insurance costs.

The table above also shows the duration of annual MIP by amortization term and LTV ratio at origination: This is the time you would be eligible to cancel and drop the monthly MIP.

Calculating the one-time 1.75% upfront mortgage insurance premium (UFMIP)

The sales price of your new home = $200,000

Min. FHA down payment required is 3.5% = $7,000

Loan amount = $193,000

One-time upfront FHA mortgage insurance premium of 1.75% ($3,377.50) added to your loan:

$193,000 + $3,377.50 = $196,377.50 your new final adjusted loan amount.

*Please be sure to check out and bookmark the handy FHA Mortgage payment calculator on the right side of your screen. This monthly loan payment calculator figures up the mortgage insurance costs automatically. In addition, it includes monthly real estate taxes and home insurance.

Note – the upfront (one-time) 1.75% FHA mortgage insurance premium can be paid separately or financed into the loan. This fee is most commonly financed or “rolled into” your new loan as stated in the example above. Please also note the figures above do not apply to the FHA streamline refinance. Please contact us.

FHA Credit Requirements:

Credit requirements for all home loans have been changing rapidly over the past few years. Most FHA lenders, banks, and brokers currently require a 600 minimum credit score for the maximum 96.5% financing. The required minimum credit score is less for those home buyers that are putting in at least 5% or greater down payment.

The minimum FHA credit score requirements alone do not guarantee FHA financing as there are certain separate requirements in place regarding bankruptcy, judgments, short sales, and past foreclosures. As stated above the FHA credit requirements do change frequently, so feel free to submit your information request form (on this page) and ask our FHA Loan Specialist for the latest credit requirements.

FHA Non-Occupying Co-Borrowers & Gift Funds:

FHA will permit a co-signer that is not living in the home, unlike conventional loans in which the borrower needs to meet certain qualifying ratios even if they have a co-signer. This can be an advantage for first-time home buyers that need some additional income to help qualify.

However, co-signers with good credit cannot overcome the bad credit of the primary borrower. This means the qualifying credit score used will be the lower of the primary borrower and co-signer. The co-signer is generally required to be a family member or guardian.

With FHA home loans, 100% of the co-signers income can be used no matter how much money the borrower makes. This also can help the borrower to achieve the maximum FHA loan limit depending on what county they are purchasing. Each county has different FHA loan amount limits.

Having a co-signer can help those borrowers who might have some income that they cannot properly document, knowing they can still make the higher mortgage payment. One thing to keep in mind is that co-borrowers debt is also used in this equation. If their debt is extremely high, the co-signer might not help the situation.

As for gift funds, FHA does permit the home buyer to use gift money for their down payment. Generally, the buyer will need to provide proof of the gift funds (canceled check, deposit proof, etc) in addition a gift letter will be needed showing no repayment of the gift is necessary.

We are always happy to answer your questions about the latest FHA home loan mortgage details and assist you with your FHA loan application pre-approval. To fast-track your request, please fill out the short information request form on this page or call ph: 800-743-7556

Rural area homebuyers can learn more about the 100% USDA mortgage here. Veterans and military homebuyers can learn about the VA Home loan here.

Other FHA Loan Programs:

Other FHA Loan Programs: