Home loan limits at first glance may seem a bit confusing, especially for those preparing to buy their first home. In Arizona, whether the property is located in Phoenix, Scottsdale, Tempe, Flagstaff the current conforming loan limit for 2024 is $766,550.

Home loan limits at first glance may seem a bit confusing, especially for those preparing to buy their first home. In Arizona, whether the property is located in Phoenix, Scottsdale, Tempe, Flagstaff the current conforming loan limit for 2024 is $766,550.

For amounts larger than $766,550, these loans are referred to as “Jumbo” mortgages. A jumbo mortgage will generally have slightly higher rates compared to loans at or below the conforming loan limit. However, these limits do not determine how much someone can borrow. The maximum loan amount a buyer can qualify for is based upon gross monthly income and credit/debt obligations, not a conforming or jumbo loan limit.

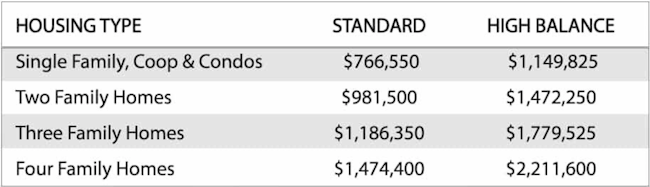

Base Conforming Loan Limits for 2024:

Instead, these limits are used to assign interest rates for various loan programs. Lenders today use what is referred to as a Loan Level Pricing Adjustment, or LLPA, which is a grid based on credit scores and down payments. Lenders who set interest rates for conforming loans can have higher or lower rates based on these risk factors. Someone with a sizable down payment of 20 percent or more, with a 740 credit score will have a lower interest rate compared to someone with a 640 score and 5% down, for example.

Updated for 2024:

Jumbo loan caps follow a similar model. Take for example a home in Phoenix on the market for $1.25 million. There are jumbo loan programs that require only a 5% down payment for loan amounts up to $2.0 million (AZ properties only) and with a 10% down payment, the loan cap is set at $2.5 million. With a conforming loan, the minimum down payment is 3% of the sales price unless someone is eligible for a VA or USDA mortgage.

While many jumbo loan lenders require a down payment of 20 percent, there are 5% and 10% options available to qualified buyers nationwide. The best is these programs do NOT require monthly private mortgage insurance.

Conforming and Jumbo loan guidelines are very similar, although jumbo loans can have slightly tighter qualification standards. Jumbo lenders can issue their own set of jumbo lending guidelines which means one lender might ask for a 20 percent down payment while another has a program with only 5% down. Also note, eligible Veterans have special VA Jumbo financing options available to them for loan amounts up to $4mil. Read more about the VA Jumbo loan guide here.

Questions? Please call Ph: 800-962-0677 to speak with a specialist 7 days a week.