Mortgage interest rates have increased in recent years, but remain at levels low enough to make home-buying affordable. More Florida first-time buyers are seeing the advantages of buying a home and building equity versus renting.

Mortgage interest rates have increased in recent years, but remain at levels low enough to make home-buying affordable. More Florida first-time buyers are seeing the advantages of buying a home and building equity versus renting.

In this post below we look at the most popular 2024 first-time buyer programs in Florida that require little to no down payment.

Buying a home and getting a mortgage is a huge financial commitment for anyone. Furthermore, there are many people involved when buying a home, many of whom you’ll never deal with again. The buyers work with a real estate agent to help search for houses, the mortgage company, inspector, appraiser, etc.

Yet none of this occurs until after a buyer is pre-approved for financing. First-time homeowners complete an application and provide paperwork documenting their income, savings in the bank, credit report, and other important financial aspects. All of this takes place in a relatively short period of time, too. First-time homeowners need also to be aware there are actually two approvals going on at the same time once a sales contract is signed.

Not only are the borrowers approved but so is the property being purchased. The property must conform to others in the neighborhood and be in overall decent condition. The home must be considered “marketable” which means there is evidence of recent sales in the area over the past 12 months.

Many are unaware that a first-time homebuyer can actually have owned a home in the past yet still be considered a “first time buyer” How so? First time buyer status technically means having not owned a home within the previous three years.

With a little bit of research and preparation beforehand, first-time buyers can feel more confident about the entire lending process and what they can expect. When obtaining a mortgage loan, first-time buyers should review all available options. Call us at the number above with questions, we have specialists standing by 7 days a week.

Florida Hometown Heroes Program:

Hometown Heroes is a down payment assistance program developed by the state of Florida and provides up to 5% ($35,000 cap) in assistance for eligible first-time buyers. This grant can be used for the buyer’s down payment, principle reduction, lender closing costs, and pre-paid escrow costs. The borrowers must be first-time buyers and work full-time for a Florida-based company.

This down payment assistance can be used together with any of the programs listed below – USDA, FHA, VA, etc. Funding for the program is limited by the state each year. Please learn more about Florida Hometown Heroes Qualifying here.

USDA Rural Development Loans:

The USDA mortgage is a government-backed program that has been around for many years. This loan is one of the last options for 100% financing. However, with USDA there are a few limitations that other popular government-sponsored loans like VA and FHA loans do not have.

There are household income caps that limit household income to 115% of the median income for the area. Note, that this household income includes all members of the house, not just the income of the applicants on the loan application.

MORE: See the complete USDA income calculator here for the 502 Guaranteed Program. Most households of 1-4 members in Fla will be limited to $110,650 through 2024

USDA loans are also limited to specific rural eligible locations. The USDA program was originally designed to help buyers finance a property in more rural locations where financing can be difficult. The property must be located in an eligible area according to the property eligibility map.

The good news is there are still many suburbs even outside of larger cities like Jacksonville, Tampa, Orlando, Ocala, Gainesville, etc, that might not seem “rural” but are still eligible. Contact us today to find a list of USDA-approved homes in your area. The list of USDA loan benefits includes:

- 100% financing, $0 down payment.

- The home seller can pay closing costs for the buyer and help minimize out of pocket expenses.

- No loan amount limits, buyers qualify based on their income/debt.

- Most single-family, townhomes and condos located in the approved map are eligible for the program. The home is not required to have a special designation by USDA, any home seller/listing is fine. Location is the important factor.

- USDA, along with all the other programs below comes with a secure 30-year fixed term with no early payoff penalty. This means homeowners can move and sell their homes anytime without penalty.

- The upfront guarantee fee of 1% of the loan amount is less when compared to FHA. The monthly mortgage insurance is also less.

FHA Mortgage:

The Federal Housing Administration, or FHA, is a division within the Department of Housing and Urban Development, or HUD. Back in 1934, FHA came out with universal guidelines banks could follow and provided a government-backed guarantee to the lender. As long as the mortgage company approves the loan application using appropriate FHA guidelines, the lender would be compensated for any loss should the buyer default on their loan.

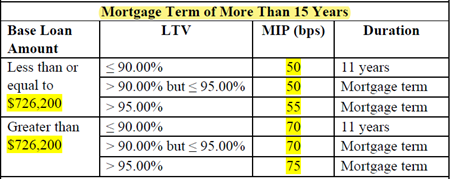

This compensation is financed by two forms of mortgage insurance, a one-time upfront policy that is added to the buyer’s loan amount and an annual mortgage insurance premium (PMI) that is paid in monthly installments. The amount is based on the down payment, please see the chart below. The FHA details page will show how to calculate.

FHA loans today remain the most popular choice for first-time buyers. However, you are not required to be a first-time buyer to participate in the program. FHA loans require only a 3.5% down payment, which means less cash is required at the closing table. FHA loans are not restricted by income or location but do require the buyers to occupy the property as their full-time primary residence.

FHA loans cannot be used to finance a rental property or vacation home for example. FHA loans can be used to finance a 2-4 unit property such as a duplex or fourplex as long as the buyers occupy one of the units. FHA loans are also more forgiving as it relates to credit and income qualifying.

FHA loans are “fully documented” loans, like all government and conventional loans. This means the borrower’s income, employment, and assets are verified through third parties. Borrowers will be asked to provide copies of their most recent paycheck stubs covering a 60-day period as well as provide the previous two years of W2 forms.

If a borrower is self-employed or receives more than 25% of annual income from sources other than an employer, two years of complete tax returns will be needed as well. To make sure there are sufficient funds to cover the 3.5% down payment and closing costs, copies of bank statements will be needed.

While FHA loans don’t limit the amount of income borrowers can earn, they do pose loan amount limits that vary based on property location. Buyers can read about all the latest loan limits and FHA details here.

FHA also offers a special renovation program for the buyer who wants to purchase a home in need of repairs. Read more about the FHA 203K loan details here. In addition, down payment assistance is also available in select cases.

VA Mortgage:

VA loans are still 100% financing for both eligible active military and Veterans. This program is probably the best option for qualified Vets who want to purchase a home with as little cash as possible. VA now permits 100% financing loans up to $4mil for qualified veterans. VA loans are only available to veterans of the armed forces, active-duty personnel with more than 180 days of service, members of the National Guard and Armed Forces Reserves with six years of service qualify and surviving spouses of veterans who died while serving or as a result of a service-related injury.

VA home buyers are also restricted from paying certain closing costs, this helps reduce out of pocket costs more. Borrowers may only pay for an appraisal, credit report, discount points, title insurance and related charges, origination fees, survey or abstract and recording fees. All other charges must be paid for by others, typically the seller or with a credit from the lender.

VA loans also come with a guarantee to the lender should the loan go into default. This guarantee is 25% of the loss and is financed with what is referred to as the Funding Fee. The funding fee is most commonly rolled into the borrower’s loan. The percentage for most first-time use buyers financing 100% will be 2.3% of the loan amount. Please see the chart below

VA Funding Fee Chart 2024:

| VA Loan Type | Down Payment | First Time Use | 2nd – 3rd Use |

| Purchase Loans | None | 2.3% | 3.6% |

| Purchase Loans | 5% | 1.65% | 1.65% |

| Purchase Loans | 10% | 1.40% | 1.40% |

| VA Cash-Out Refinance | N/A | 2.3% | 3.6% |

| IRRRL Streamline Refinance | N/A | .50% | .50% |

NOTE: VA loans only carry a one-time funding fee, but NO monthly mortgage insurance like FHA and USDA loans.

In order for a lender to determine whether or not an applicant is eligible for a VA home loan, the lender will request a Certificate of Eligibility, or “COE” as its commonly referred to. Veterans can also request this certificate on their own, the process can take a few weeks while a mortgage lender can make the request immediately and normally get a copy of the certificate within minutes. Contact us if you need assistance. Similar to FHA and USDA loans, the VA loan can only be used to finance an owner-occupied property.

Conventional Loans

By far the most popular of all mortgage loans are those using lending guidelines set forth by Fannie Mae and Freddie Mac. While neither provides guidelines specifically for first-time buyers, borrowers will be able to choose from low down payment loans as low as 5% of the sales price and with Fannie’s HomeReady program, as little as 3% down.

Conventional loans, as with government-backed loans, provide different choices as they relate to fixed versus variable as well as loan terms. Conventional loans can be found with loan terms as short as 10 years up to 30 years. Conventional mortgages do have loan limits depending on the county, in most locations the limit is $766,550. However, high-cost locations have limits up to $1,149,825. Buyers can read more about the Conforming Loan Limits

First Time Buyer Tips:

First Time Buyer Tips:

- One of the most important factors during your mortgage pre-approval is your credit score. Borrowers can get a free credit report online at www.annualcreditreport.com, this is a free report sponsored by all the major credit repositories of TransUnion, Equifax and Experian. Get a copy of your report and look for any obvious errors. Unfortunately, credit report mistakes occur far too often. If you see errors, let your loan officer know as they may be able to help correct mistakes with proper paperwork.

- Get all your financials in order. We mentioned earlier the types of paperwork that will be needed, so make sure you have copies of your recent paycheck stubs, W2 forms and bank statements before applying.

- Don’t open up any new credit accounts while going through the mortgage process. When lenders review a credit report they look at credit scores, payment history and credit inquiries. Inquiries matter when the consumer requests new credit. Due to reporting times, a lender may not be able to determine what your monthly credit payments will be if something is charged yet not reported. Even if you decide not to take a credit card offer or otherwise change your mind, your lender will want to confirm the status of your request.

- Contact your loan officer and get an estimate of how much down payment you will need and a good idea of closing costs. If you still need to save up more cash, set a budget and a timetable.

- Your pre-approved qualifying amount is based on your income, debt and current interest rates. In some cases, buyers might be surprised to find out how much they can borrow and what their monthly payments will be. Always be sure to borrow what you feel comfortable with, not necessarily what you might qualify for.

- Once you decide on a loan program, your mortgage specialist will provide you with a range of interest rates for that program. Lower rates can often be had by paying discount points. Discount points or “points” are expressed as a percentage of the loan amount and are a form of prepaid interest. Paying a point lowers the interest rate on your loan. Work with your loan officer to see if paying points make sense and compare your options.

- Buy with your mind and not your heart. Take your time and look at several properties just make sure you don’t fall in love with a home to the point where it affects your decision making. Keep your pre-approval amount in mind when shopping.

- Shop around for homeowners insurance. There is a fine line between having a large deductible along with a monthly payment and not having enough coverage. Insurance premiums can vary in cost and too high of a premium will cut into your affordability.

- Finally, ask questions. There are many moving parts when buying and financing a home. Your loan specialist can close hundreds of loans each year, odds are you will only finance a home two or three times throughout your lifetime. If you’re not sure about something, ask questions. Your loan officer is your resource, take advantage of their experience.

Buyers can contact us 7 days a week to learn more about any of the programs mentioned. Please call the number above, or just complete the Info Request Form on this page.

First Time Buyer Tips:

First Time Buyer Tips: