Texas FHA Home Loan Criteria: The Texas housing market is going strong with increased buying activity. More first time home buyers in Dallas, Houston, Austin, San Antonio, are now entering the market and looking for mortgage options that offer flexibility and manageable terms. The Federal Housing Administration is a mortgage …Read More

First Time Home Buyers

Florida Hometown Heroes Program FAQs For 2024

Each day we receive many questions from homebuyers about the Hometown Heroes Program, please find the most common list of FAQs below. Please connect with us with any questions, or to start your application today. Buyers can also read the complete Hometown Heroes Program Guide here. Question: Who is eligible …Read More

Florida Teacher Home Loan Programs

Good news for Florida Teachers – FHA and USDA offers some great mortgage programs available for public service workers that require little to no money down. Whether you are a pre-kindergarten or a 12th-grade teacher, now you can easily realize your homeownership dream. Let’s take a deeper dive to find …Read More

Florida Government Mortgages: FHA Vs USDA

We often get the question of which government program would be better, FHA or USDA? A quick search on the internet will give you a general view of each program’s benefits. Most of them suggest the USDA loan would be the better choice, assuming you meet the two key eligibility …Read More

Titusville FHA Loan Lender

FHA home loans have continued to gain popularity for new home buyers across Florida. Many homebuyers around Titusville, New Smyrna Beach and Cocoa Beach want financing options that offer min down payment like the FHA program. In addition to the low 3.5% down payment requirement, FHA recently announced the monthly …Read More

2024 Government Loan Options

Pretty much all the Government-backed mortgages like FHA, USDA and VA require the same things when getting pre-approved. Here are several key points to think about when deciding to apply for a Government home loan. We also included a short description of the most popular 2024 Government Loan Options today. …Read More

Tennessee First Time Home Owners – 2024 Updates

Tennessee First Time Home Owners have some wonderful choices for mortgage financing this year. The most popular home loans for first-time buyers are Government-backed programs like USDA, FHA, and VA loans. Below we will talk about each program, and discuss the advantages to help you choose the option best for …Read More

Tips for First Time Homebuyers 2024

Are you gearing up to buy your very first home? We’re heading into home buying season and before long the next thing you know you’ll be living in your brand new home. Buying a home and getting a mortgage is a brand new adventure for many, so to make the …Read More

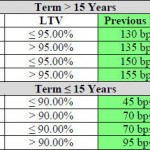

FHA Mortgage Insurance Calculator 2024

We recently revised our FHA mortgage payment calculator on the right side of the page. This FHA mortgage payment calculator figures the principal, loan interest, taxes, home insurance, and FHA mortgage insurance “PMI” costs. Homebuyers will want to adjust the taxes and home insurance as needed, as each home will …Read More

Georgia FHA Loan Requirements

FHA mortgage loans are a popular home financing choice for many first-time home buyers in Georgia. The Georgia FHA mortgage program provides several benefits, keeping in mind the budget difficulties of many homeowners who are considering purchasing their first home. Compared to most traditional mortgage loans, the FHA mortgage loan …Read More