HUD recently announced the Federal Housing Administration (FHA), will reduce its annual mortgage insurance premium by 0.30 percentage points 0n March 20th from 0.85% to 0.55% for new home buyers financing above 95%

HUD recently announced the Federal Housing Administration (FHA), will reduce its annual mortgage insurance premium by 0.30 percentage points 0n March 20th from 0.85% to 0.55% for new home buyers financing above 95%

The FHA mortgage insurance premium (MIP) fee is the monthly fee that homeowners with FHA-insured loans pay on top of their monthly principal and interest payments.

The new mortgage insurance reduction will save homebuyers with new FHA-insured mortgages an average of $800 per year. In addition, this change will reduce the housing costs for thousands of new homebuyers in 2024.

Let’s look at how to calculate the FHA mortgage insurance and an example of the new savings:

Borrower financing 96.5% with a 30-year fixed term and a loan amount of $300,000

Old MIP Rate: $300,000 x .85 = $2,550 per year or $212.50 per month

New MIP Rate: $300,000 x .55 =$1,650 per year or $137.50 per month

In this example, the homebuyer will save $900 per year or $75.00 per month on their payment.

FHA-insured mortgages account for nearly 8% of home sales in the last year and are targeted at first-time homebuyers due to their low down payment and flexible credit requirements.

The new reduced fee will make homeownership more affordable to even more qualified buyers. In addition, this will help existing homeowners that want to refinance into an FHA loan. FHA offers standard home purchase programs, plus rate-term, and cash-out refinance programs.

FHA mortgage insurance is an important part of the home loan process and it is important to understand how it can affect your overall costs. With this knowledge, you can now decide what type of loan is best for you and how much you can save.

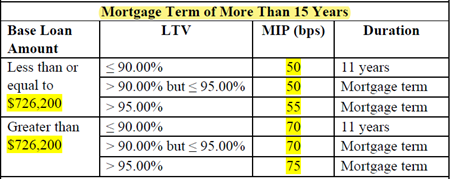

Please find the latest mortgage insurance chart below and connect with us with any questions about getting qualified for an FHA. Homebuyers can call the number above, or just submit the Info Request Form on this page.