FHA mortgage loans are a great choice for Tallahassee first-time home buyers. In this article, we will talk briefly about what FHA does, and the benefits of the FHA mortgage program.

FHA mortgage loans are a great choice for Tallahassee first-time home buyers. In this article, we will talk briefly about what FHA does, and the benefits of the FHA mortgage program.

First and foremost, FHA does not actually lend people money directly; they only insure the loan with approved lenders and banks against loss. FHA loans are given to consumers through FHA-approved lenders who lend money to consumers who have FHA insurance for the loans.

FHA loans are meant to help people by offering lower mandatory down payments. This is great for Tallahassee first-time homeowners that have min savings.

Approved lenders and banks also like the FHA program because FHA insures that if the loans default, then the lender gets repaid out of the FHA insurance fund. The FHA loan program was initially developed in the 1930s as a way to help the housing market gain traction and it has helped millions of families get into a home that would have otherwise not qualified for traditional conventional type financing.

Tallahassee FHA Loan Benefits:

FHA loans have risen in popularity in recent years because lenders have increased requirements (especially down payments) for other loans. When compared to other types of loans, FHA loans are generally easier to qualify for due to flexible guidelines and lower down payment requirements.

How to get started and pre approved for FHA Loan:

The first step to qualifying for an FHA loan is to work with a loan officer to discuss your goals. The loan officer will discuss all the application and pre-approval requirements. The entire process usually takes less than 30 min. General FHA loan requirements include:

- Credit score: The min FHA credit score standards will depend on the amount of money you put down on your new home – 3.5%, 5%, 10%. The min requirements generally start at 600.

- Florida first-time homeowners who meet income requirements may be eligible for the Hometown Heroes program. This program provides up to $35,000 in down payment and closing costs assistance.

- Documenting an employment history over the last two years. FHA guidelines consider the last two years of employment and look at a steady pay history or employment with the same employer.

- Homebuyers also must have a valid social security number and be a resident of the US. There are exceptions for resident aliens, but these exceptions can vary by lender.

- FHA loans require a minimum down payment of 3.5% when buying a home – but the down payment may be a gift from family, etc under certain conditions.

- The subject property will need to be inspected by an FHA appraiser (through the lender) and an FHA-approved appraisal must be done. The home appraisal amount must be no lower than the sales price of the home.

- FHA Debt to income. This can also vary from lender to lender, but generally, all lenders want to see your debt-to-income ratios for housing expenses not exceed 35% of your gross monthly income. Your total debt should not be more than 45% of your gross monthly income.

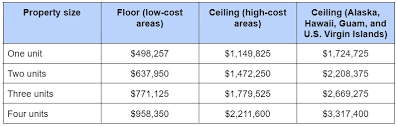

2024 FHA Loan Limits Leon County (and most of Fla)

Mortgage Insurance For FHA Loans: FHA UFMIP (PMI)

All FHA loans are required to have mortgage insurance – both up-front mortgage insurance (UFMIP) as well as monthly mortgage insurance. An up-front mortgage insurance premium (UFMIP or MIP) is an insurance premium that is collected at time of closing and is paid directly to FHA. It is financed into the loan and is 1.75% of the loan amount, regardless of the credit score.

So as an example for a $200,000 loan, you would pay 1.75% of the total loan amount or $3,500.

Homebuyers can read about all the latest FHA mortgage insurance requirements on the FHA Details page above.

FHA Mortgage Source is Florida’s leading FHA loan resource, serving you 7 days a week. Please call us at ph: 800-743-7556 or submit the quick Info Request Form on this page. Serving all of Leon County / Tallahassee 7 days a week. FHA mortgage lenders

Homebuyers looking to purchase in more rural locations of Leon County should also look into the USDA Housing Loan