The Federal Housing Administration (FHA) announced today the maximum loan limits will increase in 2024. The loan limit in lower-cost areas will be $498,257 or about 65 percent of the national conforming loan limit of $766,550.

The Federal Housing Administration (FHA) announced today the maximum loan limits will increase in 2024. The loan limit in lower-cost areas will be $498,257 or about 65 percent of the national conforming loan limit of $766,550.

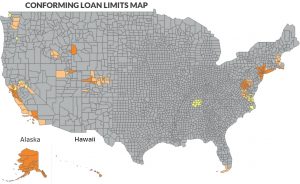

In high-cost areas, the limit will be over $1,000,000. Approximately 82% of U.S. counties are considered lower-cost areas, with 2.3% somewhere in between. Buyers can see the U.S. map below, the colored locations represent high-cost locations. Please find the complete list of 2024 FHA loan limits here.

FHA home loans provide many great benefits to approved home buyers as detailed below.

- Low down payment of only 3.5% is required. Down payment funds can come in the form of a gift or from eligible down payment assistance, bond money or grant funds.

- Low fixed interest rates. FHA loans offer some of the lowest interest rates available today.

- Flexible credit and debt-to-income ratios.

- First-time buyers AND seasoned home buyers can be eligible.

- Simple FHA streamline refinance options available.

Buyers can learn more about all the FHA mortgage details here. Please contact us today with questions by calling the number above, or just fill out the Info Request Form on this page.