FHA loans are perhaps the most popular mortgage choice for buyers in Orlando and the surrounding counties. In this post, we will discuss the Orlando FHA loan details and benefits that home buyers should know.

FHA loans are perhaps the most popular mortgage choice for buyers in Orlando and the surrounding counties. In this post, we will discuss the Orlando FHA loan details and benefits that home buyers should know.

The Federal Housing Administration introduced the FHA loan program in 1934 in order to bring some semblance of stability to the home loan industry as individual banks used their own internal approval guidelines that could require down payments as high as 50% and for very short terms, such as three to five years, requiring the borrowers to refinance the loan at the end of that initial period.

Mortgage companies like to approve FHA loans because the lending guidelines, set by the FHA, are easy to follow and the individual loan comes with an inherent government guarantee. This guarantee compensates a lender for a loss on the loan should the home be foreclosed upon. As long as it is shown the lender approved an FHA loan using established FHA guidelines, the lender receives compensation for the loss.

This guarantee is financed by the borrowers in the form of two separate mortgage insurance policies. The initial policy is referred to as the upfront mortgage insurance premium and is typically rolled into the loan amount and does not have to be paid for out of pocket. The second policy is an annual one that is paid in monthly installments during the course of the loan, most people know this term as “PMI”

As with other government-backed mortgage programs, FHA loans are only used to finance an owner-occupied property and may not be used to finance a rental property, a second home, or a vacation or beach property. FHA loans are permitted for single-family residences, approved condos, and townhomes as long as the borrowers occupy the home as a primary residence. Investors wishing to purchase an investment home can learn about Orlando DSCR loans here.

Questions? Contact us 7 days a week by calling or submitting the short Info Request Form.

Underwriting guidelines for FHA loans are considered to be relaxed somewhat compared to say conventional loans with a 5% down payment. Lenders will pull a credit report from each of the three credit repositories, Experian, Transunion and Experian.

These three-digit credit scores range from 300 to 850 with the higher score indicating better credit. Approved FHA lenders typically ask for a minimum credit score of 600, for a max of 96.5% financing. Homebuyers with a 5% or 10% down payment can often be approved with lower credit scores. This can be compared to certain conventional loans that ask for a 680 credit score or higher.

FHA loans ask there be at least a two-year employment history of full-time employment. Part-time employment can be used on a case-by-case basis if a two-year history can be verified as well as the likelihood the part-time income will continue into the future.

FHA loans ask there be at least a two-year employment history of full-time employment. Part-time employment can be used on a case-by-case basis if a two-year history can be verified as well as the likelihood the part-time income will continue into the future.

The lender uses the gross monthly income of all borrowers on the application, which is verified by reviewing copies of the most recent check stubs covering a 60-day period as well as the most recent two years’ W2 forms.

For those who are self-employed, lenders will require the two most recent filed federal income tax returns, both personal and business. A business owner will also be asked to provide a year-to-date profit and loss statement.

FHA loans ask for a down payment of only 3.5% of the sales price. For a $250,000 sales price, the down payment is then $8,750. Interest rates for FHA loans are as competitive as any other loan program and can be even more competitive when looking at a conventional loan with a 5% down payment.

Note: Income Florida first-time buyers also have the Florida Hometown Heroes Program available to provide down payment and closing costs assistance.

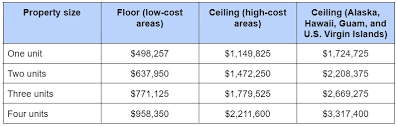

The current FHA loan limits for most of Florida (Orange County included) is $498,257 for a standard 1-unit property, some counties have set limits even higher. Please see the chart below for multi-unit properties.

Homebuyers who have questions or want to get approved can contact us at the number above, or just submit the quick Info Request Form on this page.