Pretty much all the Government-backed mortgages like FHA, USDA and VA require the same things when getting pre-approved. Here are several key points to think about when deciding to apply for a Government home loan. We also included a short description of the most popular 2024 Government Loan Options today.

Pretty much all the Government-backed mortgages like FHA, USDA and VA require the same things when getting pre-approved. Here are several key points to think about when deciding to apply for a Government home loan. We also included a short description of the most popular 2024 Government Loan Options today.

Household Income:

Income must be consistent and documentable in 2024. The times of “stated income” or no documentation loans are long gone memories. Showing income properly will often present an issue with self-employed or 1099 workers, particularly those who have not been independently employed for not less than 2 years.

Finance companies and banks frequently wish to see a Two-year employment history. Minor interruptions in a borrower’s employment history might be okay, just as long the gap isn’t a long time or unexplained. Recent college graduates usually are exempt from the 2-year employment regulation.

Credit Restrictions:

In most cases, a 620 FICO score is necessary to get approved for the USDA government home mortgages today. Other programs like FHA and VA loans can be done with lower FICO scores, especially with a down payment of 5% or 10%. In addition, do not forget that a credit score requirement DOES NOT guarantee loan approval, just about all banks and lenders have even more waiting time for home buyers having any previous bankruptcy proceedings, property foreclosures, or short sales. Even more time is also required for USDA Rural loans. A clean 12-month payment history on any other consumer credit lines is crucial to look after.

Below we have listed a brief description of each government mortgage program available today. These are all great options for first-time home buyers. Please reach out to us today by calling Ph: 800-743-7556 or just submit the quick Info Request Form on this page.

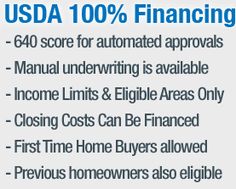

USDA 502 Guaranteed Rural Loan:

USDA loans are backed by the United States Department of Agriculture and Rural Housing. USDA loans are available to just about any homebuyer wishing to purchase a home within a rural-defined location. Many locations you wouldn’t think, are in fact still eligible today. The definition of “rural” is pretty loose when it comes to USDA Rural Housing loans. Click here for the USDA eligibility map.

USDA loans usually have household income restrictions in accordance with the amount of family members in the home, county, etc. USDA and VA are the only residential loans in that still offer 100% financing with NO down payment. Read all the latest USDA FAQ’s here.

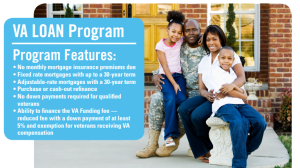

VA Home Mortgages:

Offered to all eligible prior and existing armed forces members. Backed by the Veterans Administration, the VA loan is one of only two home loans that allows 100% financing.

Offered to all eligible prior and existing armed forces members. Backed by the Veterans Administration, the VA loan is one of only two home loans that allows 100% financing.

- VA 100% financing home purchases: Most conventional lenders require at least 5% down payment which is not possible for many Veterans and military families. FHA requires a 3.5% down payment and requires monthly mortgage insurance. Because a VA Mortgage is guaranteed to the lender (by Veterans Administration) they do not require a down payment.

- VA loans have very low interest rates: Because VA Mortgages are guaranteed by the Department of Veterans Affairs, the risk level associated with default is much lower. As a result, the interest rates are usually lower than a conventional program with less than 20% down. Like a VA loan, FHA and USDA loan programs are also backed by the government and have similar interest rates.

- Simple qualifying criteria: VA Mortgage guidelines are more flexible than many other loan programs. The VA mortgage is guaranteed by the government and most lenders have lower credit requirements, making them easier to qualify. The current minimum credit score requirement for most lenders is 600.

- NO mortgage insurance (PMI): Even with a $0 down payment, a VA Mortgage does not have mortgage insurance (PMI) as part of the monthly payment. Conventional programs with less than 20% down and FHA both have expensive mortgage insurance that can cost buyers several hundred dollars every month. Contact us today to learn more about the latest VA purchase options.

FHA Home Loans:

Backed by the Federal Housing Administration, FHA loans remain the most popular option for home buyers today in the U.S. FHA home mortgages require a minimum 3.5% down payment, and there are no gross income limits, regulations, or property location disadvantages like USDA. FHA loans also allow for the home seller to pay up to 6% of the buyer’s closing costs.

Backed by the Federal Housing Administration, FHA loans remain the most popular option for home buyers today in the U.S. FHA home mortgages require a minimum 3.5% down payment, and there are no gross income limits, regulations, or property location disadvantages like USDA. FHA loans also allow for the home seller to pay up to 6% of the buyer’s closing costs.

In addition, FHA allows for non-occupying co-borrowers to help others get approved for the loan. FHA loans, like other government loans, have a secure 30 or 15-year fixed term with no early payoff penalty.

Homeowners who presently have a VA, USDA, and FHA loan should look into the wide range of streamline loan refinancing alternatives available today. Interest rates are currently near all-time low levels. All these products allow the homeowners to re-finance REGARDLESS of the mortgage loan to value. If you now have a USDA Mortgage loan, you can learn more here about the USDA refinance program. Homeowners that have a VA loan can click to learn more about the VA IRRRL Refinance Program. Homeowners with an FHA can learn more about the FHA Streamline Refinance here.

FHA Mortgage Source is a leading Government loan resource. Please reach out to us today by calling 800-743-7556 or just submit the quick Info Request Form on this page.