We recently revised our FHA mortgage payment calculator on the right side of the page. This FHA mortgage payment calculator figures the principal, loan interest, taxes, home insurance, and FHA mortgage insurance “PMI” costs.

We recently revised our FHA mortgage payment calculator on the right side of the page. This FHA mortgage payment calculator figures the principal, loan interest, taxes, home insurance, and FHA mortgage insurance “PMI” costs.

Homebuyers will want to adjust the taxes and home insurance as needed, as each home will be different. You can look up annual taxes at the county tax site, or other real estate websites like Zillow or Trulia. Annual homeowners insurance estimates can be obtained by contacting any trusted insurance company.

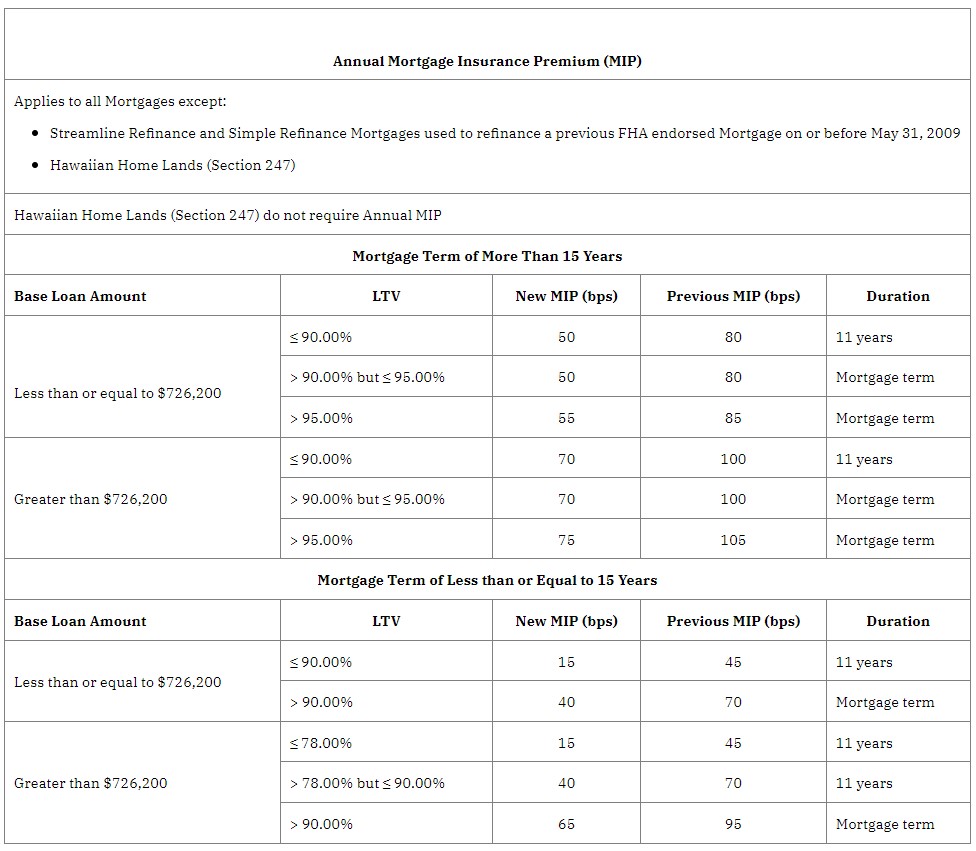

FHA monthly mortgage insurance is adjusted based on the down payment, loan amount, the term (30 or 15-year fixed), and loan to value. The majority of FHA borrowers choose a 30-year fixed term with a 3.5% down payment. In this case, the monthly mortgage insurance factor would be .55% as of 2024.

The one-time upfront (UPMIP) would be 1.75% – this is commonly added to the buyer’s final loan amount. This is great especially for buyers with lower credit scores, as mortgage insurance for conventional loans (95%+ financing) commonly requires a 680+ credit score even to be able to obtain mortgage insurance.

Borrowers who put down 5% or more will see their MI costs even lower. Keep in mind FHA reduced mortgage insurance recently. Not only is this good for new home buyers entering the housing market, but it will also help current FHA homeowners interested in a refinance.

Please contact us and see if the new lower FHA mortgage insurance costs could help reduce your monthly mortgage payment. The FHA streamline refinance makes the process easy with no appraisal and little paper work.

Please see the new FHA monthly mortgage insurance chart below: Buyers who have questions are encouraged to contact us by calling 800-743-7556 or by submitting the Info Request form on your screen. We have an FHA loan specialist standing by 7 days a week to assist you.