Housing and Urban Development (HUD) announced today that FHA would REDUCE monthly mortgage insurance fees by more than 1/3, from 1.35% of the loan amount down to .85 percent. The “annual premiums” on FHA mortgages, a very popular financing option for Florida first time home buyers, have increased five times since 2010.

Housing and Urban Development (HUD) announced today that FHA would REDUCE monthly mortgage insurance fees by more than 1/3, from 1.35% of the loan amount down to .85 percent. The “annual premiums” on FHA mortgages, a very popular financing option for Florida first time home buyers, have increased five times since 2010.

Jan 2024: Please find new updates on MIP here.

They jumped from .55 percent of a loan’s value to 1.35 percent in 2014, which is simply outrageous to many. Those fees will finally drop to .85% toward the end of January. The White House projects the lower premiums will entice 250,000 more home buyers to take out FHA loans in the next three years, and that the new borrowers will save an average of $900 annually.

The FHA does not make loans. It insures approved lenders against losses should the loans go bad, and it uses borrower fees to cover those losses. FHA Mortgage insurance is required for all borrowers taking out an FHA mortgage, it’s meant to protect the lenders in case of default by allowing them to recoup some of their losses. FHA has both a one-time up-front funding fee of 1.75%, plus the monthly annual fee that will now be reduced to .85% for maximum 97.5% financing. Let’s break down the math below in this short comparison of a $200,000 FHA mortgage:

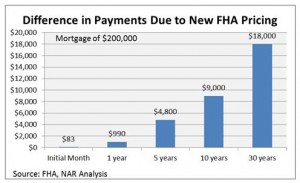

Old – FHA monthly mortgage insurance @ 1.35% = $225.00 per month added to the borrowers monthly mortgage payment.

Now – FHA monthly mortgage insurance @ .85% = $141.67 per month added to the borrowers monthly mortgage payment.

$200,000 x .0085% = $1,700 – 1,700 / 12 = $141.67 = Savings of $83.00 per month!

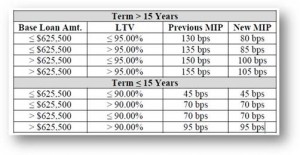

Here is a chart of the new FHA monthly MI premiums for new FHA case number assigned on or before January 26, 2015

Here is a long term graph of the savings for a $200,000 mortgage:

This is really a big deal for new home buyers entering the market in 2015. In addition to homeowners that currently have an older FHA mortgage with the higher insurance premium, as these homeowners may want to consider an FHA streamline refinance. So what’s behind the sudden reduction of FHA fees? Well the FHA finances took a blow after the housing bust back 6-7 years ago, when many borrowers flocked to FHA for financing because credit was tight everywhere else.

The FHA’s loan volume soared as a result, but so did its default rate. The losses eroded the agency’s cash reserves to a level well below what is required by law. FHA kept raising its fees to beef up its cash reserves. FHA finances, along with the market have since improved. FHA recently announced that its reserves are back for the first time in two years, and an independent audit of the agency’s finances predicts that the agency will reach the level required by law by 2016.

The new premiums are scheduled to kick in late January 2015. Stay tuned into out FHA news page here as there will be more details provided soon on the lower mortgage insurance costs and FHA refinance benefits.

Florida home buyers that have questions can reach out to us 7 days a week by calling 800-743-7556, or just submit the quick Info Request Form on this page.

FHA To Reduce Monthly Mortgage Insurance