An FHA insured mortgage is a home loan guaranteed by the United States Federal Housing Administration and processed by an FHA approved lender or banks. The Federal Housing Administration loan program started in the 1930s during the Great Depression. The goal of the program was to try to protect lenders and home …Read More

FHA Refinance

FHA Home Loan Q&A

Each day we receive many questions about FHA mortgages from prospective homebuyers. Below we have listed a few of the most common FHA Home Loan Q&A. Do you have a question? Contact us at Ph: 800-743-7556 or just submit the quick info request form on this page. Q: What …Read More

2024 FHA Monthly Payment Calculator

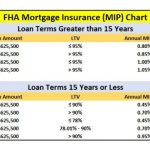

Homebuyers want to be sure they use an accurate FHA mortgage payment calculator when figuring up monthly loan payments. Keep in mind many online mortgage payment calculators do NOT apply the applicable mortgage insurance, taxes, and insurance. Please note each mortgage program has different monthly mortgage insurance (MIP, PMI) amounts. …Read More

2024 FHA Qualifying Guidelines

The FHA loan program is a mortgage loan that is insured by the Federal Housing Administration (FHA). The federal government insures loans for FHA-approved lenders in order to reduce their risk of loss if a borrower defaults on their mortgage payments. In addition to FHA, the federal government also has …Read More

FHA Streamline Benefits, Rates –

Do you have an FHA insured mortgage on your home? If so you may have the opportunity to refinance with an FHA streamline refinance. The FHA streamline refi makes refinancing easy for Florida homeowners. Unlike other mortgage refinance options, the FHA streamline refinance program offers Florida borrowers with an existing FHA …Read More

Key Largo, Key West FHA Down Payment

FHA (The Federal Housing Administration) which is part of the U.S. Department of Housing and Urban Development (HUD), provides different mortgage programs that helps make homeownership easier for Florida home buyers to purchase with limited credit, down payment and resources. Everyone knows that South Florida real estate is expensive and …Read More

FHA To Reduce Monthly Mortgage Insurance

Housing and Urban Development (HUD) announced today that FHA would REDUCE monthly mortgage insurance fees by more than 1/3, from 1.35% of the loan amount down to .85 percent. The “annual premiums” on FHA mortgages, a very popular financing option for Florida first time home buyers, have increased five times since …Read More

FHA Document Checklist

Florida homebuyers will need a few documents when applying for the FHA loan. During the FHA mortgage application, the lender will request a few things needed to expedite the pre-approval process. If you have questions about any part of the FHA purchase or refinance process, please contact us. You can …Read More

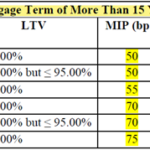

FHA Changing Mortgage Insurance Costs

FHA announced some new changes in regards to monthly Mortgage Insurance Premium (MIP) also more commonly known as PMI. Monthly insurance is currently canceled once the homeowner has been living in the home for 5 years and reached a loan to value of 78% or less. The new FHA MIP …Read More

FHA TO ENCOURAGE STREAMLINE REFINANCING

Today, Acting Federal Housing (FHA) Commissioner Carol Galante announced significant price cuts to FHA’s Streamline Refinance Program that could benefit millions of borrowers whose mortgages are currently insured by FHA. Beginning June 11, 2012, FHA will lower its Upfront Mortgage Insurance Premium (UFMIP) to just .01 percent and reduce its …Read More